Pent up demand gets the PE flywheel running again

Polish up your value creation toolkit - the 2023 freeze in private equity deal activity is about to thaw.

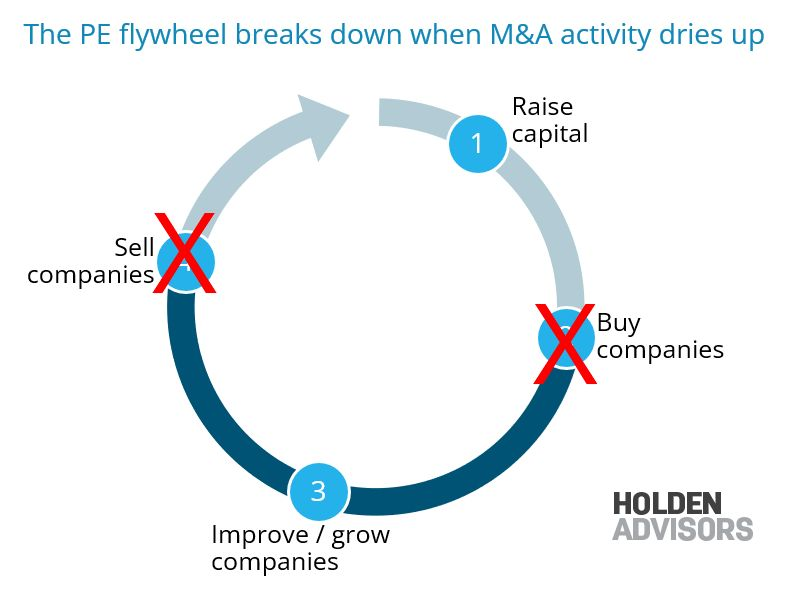

All businesses, from startups to MM to the F500, operate with a business model flywheel. In PE, we can simplify this into four steps: raise capital, buy companies, improve/grow those companies, sell companies. Simple, right? Completing each step is crucial to feed the inputs for the subsequent step. If PEG success could be estimated by multiplying the outcomes of these steps (1 x 2 x 3 x 4), then you can't have a zero in any of those places.

Unfortunately, the 2023 market experienced a breakdown in two key areas, throwing a wrench in this flywheel:

1. Deal activity, which impacts both the buying and selling of companies, was crushed in 2023. Market-wide total buyout and exit values were down by 60%+ vs. their 2021 peaks, driven primarily by a drop off in deals closed (exits down >50% vs. 2021).

2. Demonstrating the interconnectedness of the flywheel, when LPs don't receive exit-generated distributions, they have less capital to reinvest in subsequent GP funding rounds and become more discerning with future allocations.

In this respect, the 525bps increase in US central bank rates since March 2022 had its desired effect. But the tide seems to be turning. The 2024 outlook hints at thawing the freeze in PE deal activity.

1. The new normal. After a period of cheap money, investors (not potential home buyers) have begun to accept that today's interest rates are historically normal, and the show must go on.

2. Dry powder. The $1.2T pile of money on the sidelines is both the largest we've seen in 7+ years, but even more significantly over a quarter of it is getting stale (4+ years since it was raised) making LPs impatient and putting pressure on GPs to deploy it.

This pent-up demand sets the stage for the industry to press the "go" button again.

What does this all mean? Deal teams (buy and sell sides) - get your pencils out. Ops teams - time to dust off those 100-day plans. Let's go.

__________________________________

Source: Bain 2024 Private Equity Report https://www.bain.com/globalassets/noindex/2024/bain_report_global-private-equity-report-2024.pdf

Sign Up for Insights

Holden Advisors is a team of experts in pricing and sales performance.

We help build and protect our clients’ pricing power by leveraging decades of expertise in negotiation, sales strategy, and value-based pricing.

© Holden Advisors. All rights reserved | Privacy Policy