How to build pricing power in the age of Gen AI

If you’re a CEO in SaaS, you’re feeling the pricing pressure. You’ve invested in AI, pushed to create new features, and pressed the team to innovate quickly. Then your CRO calls to say there’s a new competitor offering something similar… at 10% of your price.

Not only are you losing deals, but your valuation is getting crushed.

This is the challenge leaders are facing at this point in the AI market lifecycle. As fast as you’re working to differentiate, products are getting commoditized quickly and new ankle biter competitors are popping up constantly. Your prospects and clients are experimenting with second, third, or fourth tier tools that you’ve never heard of, or were never worried about. The pricing power and differentiation moats of last year are drying up fast.

Buyers are expecting more for less, revenue per user is dropping, and enterprise deals are shrinking. Procurement is shifting, and instead of going all-in on multi million dollar enterprise contracts, buyers are opting in for smaller, lower-commitment agreements. We’ve seen competitors give contracts away just to get in the door.

It’s a signal for how markets are changing, and your pricing needs to evolve with the way value is delivered and perceived.

As a CEO, what do you do?

As the market demands lower prices, you need to make up for lost revenue, grow your differentiation, and increase company valuation.

If you still have true differentiation, you’ll be able to build pricing power around it. But if you don’t (or can’t prove it), your price, profit, and market share will all get dragged down.

Now is the time to get pricing right, so you aren’t innovating in the wrong areas, giving value away at a discount, or getting stuck in a commodity mentality with buyers.

Here are five things to watch out for and what to do about them.

1. Change in buying center

AI is making software so lightweight, nimble, and easy to buy that traditional buying processes are evolving. We’re seeing a lot of products being purchased by the actual users and not just through IT or procurement. This creates both opportunities for sellers and risks for the buyers.

Buyers want to test before they commit. More pilots, lower initial spend, and shorter evaluation cycles. Companies are less likely to go all-in on a big enterprise contract.

The good news is, as a seller, dealing with the user directly is a huge advantage if you have true differential value. You can work with the buyer (without being blocked by procurement) to have them experience your differentiation and increase their willingness to pay. The process is streamlined and can go much smoother and faster. Especially if you’re at a lower price point!

But keep in mind, buyers at times are susceptible to your competitors’ influence through buzzword washing (“we all have AI and they are all the same”). It’s key that you find ways for prospects to experience your product’s differentiation so your value isn’t diluted through those messages.

The market is forcing change for a lot of companies: if your differential value drops, you need to lower prices. It’s not always a bad thing. A lower price typical allows for more potential buyers and a wider audience (Total Available Market), and as users explore new offerings, they may increase the number of trials they’re willing to test. This means more opportunities to get your foot in the door.

You may also now be more attractive to a market that you couldn’t or didn’t serve before – and a large user based TAM could mean that a change in your price metric will help maintain or even increase your valuation.

2. Decreased revenue per user (Protect your valuation)

Products are getting commoditized quickly. Agents and tools are widely available and cheap to use, so even if you’re first to implement new technology, your competitors may catch up fast. What was innovative and bleeding edge six months ago may be status quo next week.

This is leading to more price sensitivity on traditional software and significant downward pressure on price. Buyers are aware that technology is cheaper, faster, and easier to build. The word AI is being promised and overused, value is getting diluted, and it’s impacting company valuation.

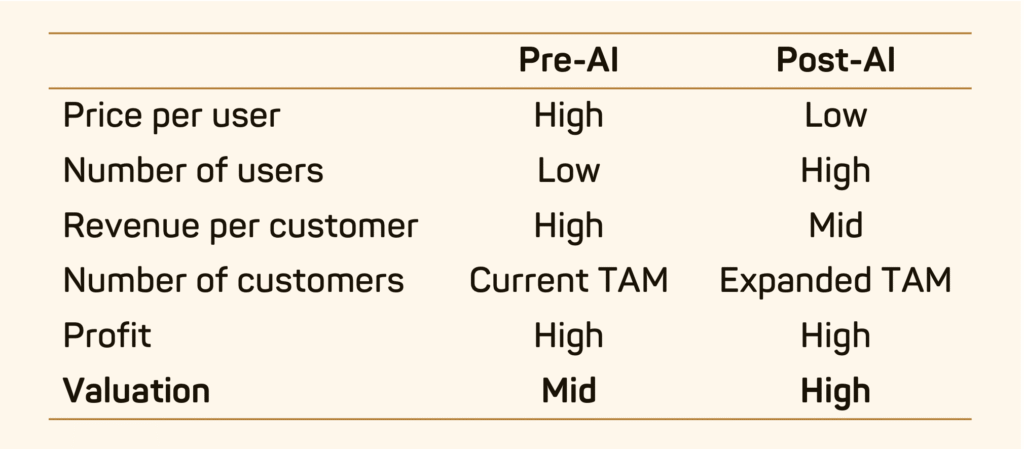

Never a good feeling. But this lower price per user can and should open up new markets (TAMs), and if you are able to align your price metric to the right scale variable, then a higher volume of users per account and / or volume of accounts can make up for that loss.

When navigated properly, these changes can be for the better:

Now we get to the change in how you price. When clients face pressure to reduce their price per seat model because of new competitors, it may be time to find other metrics to get paid better for the value you create. In this environment, tying price to seats can be a liability. When companies are trying to reduce headcount, they’re not interested in (or accruing value through) more seats.

Buyers know that development effort that previously took six months could now take you six minutes – and you can’t charge them for a year of work when it takes a day. If you can now deliver 15 tailored training programs in the time it used to build one, don’t price by the hour.

As AI features become more table stakes, your pricing model should:

1. Drop to align with value and meet market expectation and

2. Incorporate a hybrid approach to showcase your differentiation where possible

Pricing based on usage, outcomes, and impact becomes more relevant and easier to defend when markets are unpredictable. Buyers are more likely to invest when your solution helps them to close deals faster, reduce churn, or be more productive – so you need to have a good sense of your value drivers for each customer.

When you’re confident on your differentiation, look at testing hybrid pricing models with a low price point and potentially a shared benefit component.

Common metrics to price by:

Outcome focused: e.g., number of training programs, problems solved on a call, bugs fixed, certifications, equipment uptime/downtime

Usage based: e.g., compute used, # of reports created, hours of equipment used

Value based: e.g., compute type, report type, bug fixed type

Hybrid: ideal for trial, scale and value! E.g., free to try with limits, then number of calls and types of bugs fixed

($0.10/call + $2/level 1 bugs + $1/level 2 bugs + $0.50/level 3 bugs)

The most important thing is that your price is aligned to value. This is how you build and protect your pricing power in a sustainable way, while making it easier for your customers to buy. As you reevaluate pricing, you need to reassess how exactly your customer experiences the value of your products so you can quantify and charge for it fairly.

When you know exactly how they’ll accrue value, hybrid models become easier. The more your customer can see the quantified value (and experience it), the more you’ll be able to mitigate the risk of this decreased revenue. The harder it is for either to happen, the more vulnerable you are to ankle biters.

3. New ways to differentiate

With a larger TAM and a closer connection with the user community, look for opportunities to solve new problems. This is a good way to create further differentiation and stay ahead of the competition. Are you using AI to solve a customer problem you couldn’t solve before? Is your differentiation truly sustainable, or will competitors catch up in three months when they find the same off-the-shelf tool you’re building from?

It’s safe to assume that everyone now checks the box with using AI. Some even do AI only to say that they are doing AI, as if it’s a badge of accomplishment instead of truly solving a customer problem to create differentiated value.

Even if you’re relying on off the shelf products, you want to use a differentiated process to solve customer problems. If you’ve used AI to make something better or solve for a problem you weren’t able to solve for before, the next thing to do is quantify that differential value.

You have to really know you’re solving the problem more effectively than your competitor.

After that, the question is: how do I make this buyer see the value? If she doesn’t see the value, how do I make sure we can get her to see it and how it will accrue for her company over time?

Then she’ll be willing to pay for it. You need to make sure buyers can experience value that is better, greater, different from competitors before you can expect them to pay more for your solution.

Even if you’re the most differentiated solution in your market, you will still see market pressure on price. There’s not enough information about what AI will do, and there’s a flood of options and offerings available in most cases. It’s hard to separate yourself on differentiation unless your customers can actually test drive it and experience the value.

Make a low threshold for someone to come into the ecosystem and experience the solution, so you can grow her as she is accuring value through her own customers. In some cases, the metric itself can be your differentiator. Many companies are still fighting on price point instead of including outcome based pricing in a hybrid model.

When using off-the-shelf products, competitors might catch up fast if you’re not doing something that truly creates differentiation over time. If it’s not the product itself, it should be the way you’re solving the problem in some other way (including building from your own proprietary data).

Focus on what will grow your differentiation over time, and you’ll be able to build and protect your pricing power as you scale.

4. Compute costs and storage

While the tools are cheap to use, they’re not cheap to provide in the long term – so you need to be aware of the costs you’re accruing as you set and grow your foundations. Just watch out for the cost-plus trap! You have to look at what value is going to drive your overall price, the compute costs you need to manage, and how to vary your service at different levels to ensure value is aligned to fair pricing.

Typically high compute/storage should align with high value, so make sure your price model takes that into account (e.g., set a price metric based on compute type). If you’re not able to, then think about putting limits on the use driving the highest costs. This will help mitigate cost risks from first time aggressive users where there is high compute use for low value processes. That may create a bump in costs in the beginning that will stabilize over time, but you need to understand the true costs of use at scale as you think about new solutions to provide. Snowflake does a good job of managing this risk through their pricing model.

Be honest with yourself about where you have differential value, and where you don’t. In the places where you have it, make sure to quantify that impact on your customer’s business. How does your product make them money, save them money, or mitigate some kind of risk for them? As things stick and work for your customers, they can pay more for increased usage and outcomes, which benefits both of you.

5. Ability to monitor and govern

One of the biggest risks of embedding AI into your product is pricing complexity. Hybrid models are great until customers can’t understand how they’re being charged and your internal systems can’t support the model. This is a place where outcome-based pricing falls flat. Companies need to have the right infrastructure to manage usage and tiered fences in a simple way so you can charge fairly for the value your customers are accruing.

As you make these changes, are you ready to track what you need to? Is it easy for the customer to make this change? With a hybrid approach, the problem is transparency to the customer and your ability to track. You’ll use multiple metrics to price off of, and then it can get clunky internally. So you have to make it clear and simple internally so you can make the messaging to the customer really clear and simple to implement. The goal is to create a simple and friction-less buying process for your customers.

Think about what behaviors you want to incentivize – and what metrics your customer will be open to. How can you drive it at scale? How do you get your customers to use your solution and love it and use it more and more? Is your billing system correct to be able to do that? What will it take internally to get ready for it? What will it take externally for customers to get ready for it?

Final thoughts

It’s still early, but you need to get to the start line. Soon, buyers will assume AI functionality in every offering and tier. That means the window to price based on novelty is closing.

What’s left is real value – business impact and better outcomes for your customers. Make sure you’re aligning price metrics to where your buyer accrues value and building systems to scale how you price, communicate, and capture that value.

Getting it right now means having the flexibility to scale as your AI capabilities and customer expectations grow. The customer always needs to have tiered options so they’re in the driver’s seat and sellers can pull levers up or down when they press on price or features.

The work is to keep improving your value over time so you earn the pricing power you need to invest in the next level of innovation.

Sign Up for Insights

Holden Advisors is a team of experts in pricing and sales performance.

We help build and protect our clients’ pricing power by leveraging decades of expertise in negotiation, sales strategy, and value-based pricing.

© Holden Advisors. All rights reserved | Privacy Policy